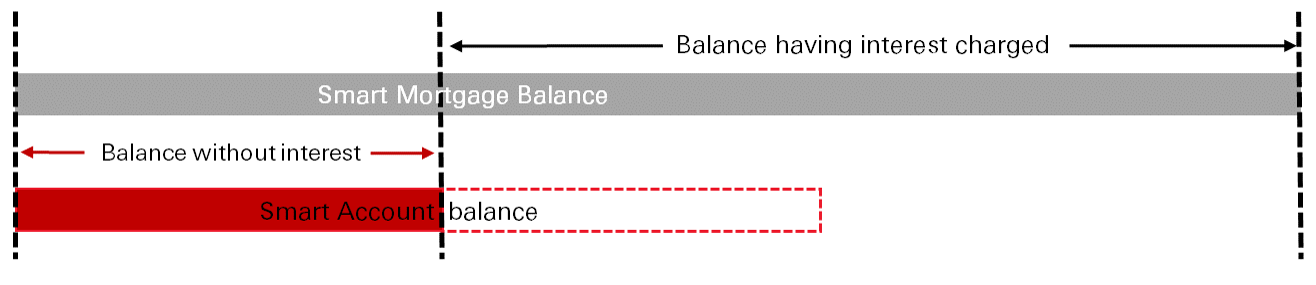

The Smart Mortgage offers flexibility to your lending and savings. Any additional funds that you pay into the Smart Account allows you to pay less for your mortgage or pay it quicker.

Why choose Smart Mortgage?

- Additional funds paid into Smart Account reduces interest charge on your mortgage loan

- Withdraw funds from your Smart Account at any time

- No minimum balance required

- Receive up to VND10Million cash-back

How it works

Daily end balance to calculate interest of the mortgage will be netted off against 50% of Smart Mortgage Account balance prior to interest calculation, which will lower the interest payment for the customer.

Reference rates and fees

Things you should know

How to apply

Please make sure you've read the information under Things you should know section

Leave your message

Apply by phone

Call us on

(84 28) 37 247 247(the South)

(84 24) 62 707 707 (the North)

Lines are open 8am to 10pm daily.

Frequently asked questions

You might also be interested in

Personal Instalment Loan

Make your plans a reality today.

Secured Overdraft

Fulfill your personal needs while being enjoy the attractive interest rates from fixed deposits.

Home Equity Loan

Enjoy flexibility of your changing needs with our attractive loan.