We'll help you pick the card that can best support your financial needs and your lifestyle.

VISA cards are international payment cards. They are made by the Visa International Service Association which is a payments network based in the US. It cooperates with different banks to provide cards.

You can use your VISA card for online shopping and make transactions around the world where the card is accepted. You can also use it to make cash withdrawals, bank transfers, and savings deposits.

VISA offers credit cards. Credit cards are a type of unsecured loan. You can use it to pay your bills and make purchases like you would with a debit card.

However, rather than using the money in your account, you'll get a credit limit. This determines how much money you can spend with your credit card. You cannot make transfers with a credit card, and we don't recommend that you use them to withdraw cash. Learn more about the pros and cons of cash advances: What is a credit card cash advance?

Apply online for an HSBC VISA credit card to receive cash back promotion up to VND2 million!

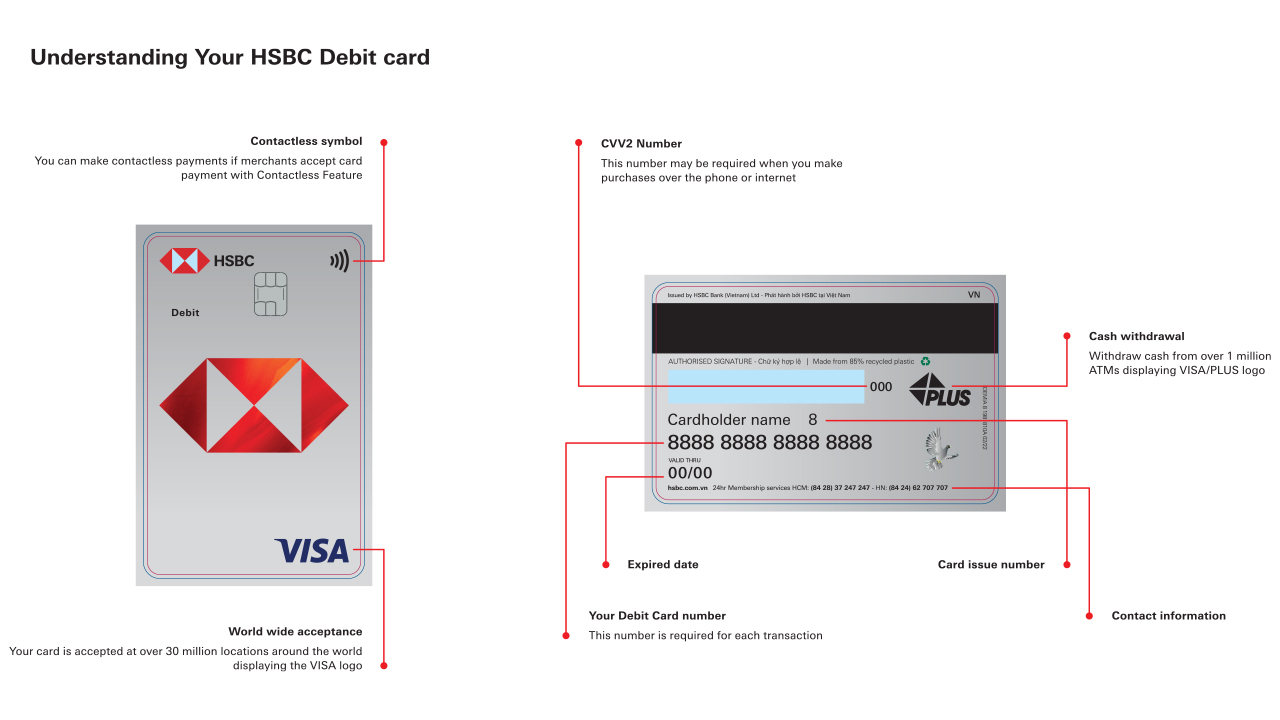

A VISA debit card directly links to your transactional account. That means, the money on the VISA debit card is your own, and you can use the card to withdraw, pay and transfer the money as much as your account balance.

There are banks that don't put a limit on the amount of money you can use in your bank account. Others will require the debit cardholders to maintain a minimum account balance.

Learn more about HSBC VISA Debit Card

A Visa card (credit or debit) is a cashless payment that's easy to use around the world. If you're thinking of getting a Visa card, here's how these two types of cards differ.

| Card | Visa credit | Visa debit |

|---|---|---|

| Spending limit | Use money from a credit line provided by the bank | Within the amount in the account |

| Function | Withdraw money at ATMs with VISA/PLUS logo Pay directly at POS machine or online Convert to instalment payment at supported stores |

Withdraw money at ATMs with VISA/PLUS logo Transfer, deposit, pay directly or online |

| Requirement | Proof of income and financial status | Open a bank account to link to your money |

| Fee and interest | Credit card typically has applicable fees and interest rates depending on the bank, including:

|

Fees and interests of debit card are regulated by each bank, including:

|

| Pros | With a Visa credit, you can:

|

With a Visa debit, you can:

|

| Cons |

|

|

| Card | Spending limit | Spending limit |

|---|---|---|

| Visa credit | Use money from a credit line provided by the bank | Use money from a credit line provided by the bank |

| Visa debit | Within the amount in the account | Within the amount in the account |

| Card | Function | Function |

| Visa credit |

Withdraw money at ATMs with VISA/PLUS logo Pay directly at POS machine or online Convert to instalment payment at supported stores |

Withdraw money at ATMs with VISA/PLUS logo Pay directly at POS machine or online Convert to instalment payment at supported stores |

| Visa debit |

Withdraw money at ATMs with VISA/PLUS logo Transfer, deposit, pay directly or online |

Withdraw money at ATMs with VISA/PLUS logo Transfer, deposit, pay directly or online |

| Card | Requirement | Requirement |

| Visa credit | Proof of income and financial status | Proof of income and financial status |

| Visa debit | Open a bank account to link to your money | Open a bank account to link to your money |

| Card | Fee and interest | Fee and interest |

| Visa credit |

Credit card typically has applicable fees and interest rates depending on the bank, including:

|

Credit card typically has applicable fees and interest rates depending on the bank, including:

|

| Visa debit |

Fees and interests of debit card are regulated by each bank, including:

|

Fees and interests of debit card are regulated by each bank, including:

|

| Card | Pros | Pros |

| Visa credit |

With a Visa credit, you can:

|

With a Visa credit, you can:

|

| Visa debit |

With a Visa debit, you can:

|

With a Visa debit, you can:

|

| Card | Cons | Cons |

| Visa credit |

|

|

| Visa debit |

|

|

VISA cards are useful for when you travel, work, or study abroad, and for when you make payments online. You can use them to make payments globally without cash or needing to exchange money. This type of card is accepted in many places, so you won't need to worry about how much cash you can take into another country when you travel.

VISA cards can also be used for domestic payments. You can also enjoy discounts when using it. We offer discounts of up to 40% off on food, shopping, sports, beauty, entertainment, education, travel, and more at thousands of stores across Vietnam. Find out more by checking our daily offers.

Learn how to make your HSBC credit card payment for easy ways to pay off your HSBC credit card balance.

Almost every VISA card is equipped with an EMV chip to prevent fraud and data theft.

You carry risk when you carry a lot of cash, whether it be dropping cash or having it stolen, never to be recovered. In the case you lose your card, you can immediately lock the card via the banking support center or the mobile banking app, preventing any loss of money. Note that your card will only be successfully locked when you receive a confirmation from the card issuer.

You can also set a transfer limit on your debit card or credit limit if it is a credit card for maximum security.

With any type of VISA cards, all your purchases get recorded online with all the essential details—where, when, how much. This helps you self-assess and reconcile your spending so that you can budget better.

In addition, you can make use of instalment plans offered by VISA cards to shop for your favorite items immediately and then spread the costs over several monthly payments, instead of paying all at once.

Using your VISA card responsibly with proper planning is a great way to save later down the road.

It's easy to understand how to use the VISA card:

When you go shopping or pay for services at a store or service provider, usually, the store clerk will swipe the magnetic strip on the back of the card or insert the card into the POS or mPOS. Some cards will require you to enter a PIN to complete the payments, while others do not require this action. Some banks even offer the function of integrating VISA card into your phone, such as Samsung Pay technology, to help you pay via POS and mPOS without the need of physical bank cards.

You now can integrate HSBC VISA card's information into your compatible Samsung smart devices. Make fast and secured transactions just by simply tapping the device on a POS device.

Find out more about our service: Pay with HSBC Visa Card using Samsung Pay

So, what is POS?

POS (Point of Sale) is a payment terminal that takes credit or debit cards to make a payment instead of cash. This handheld device is usually placed at checkout counters at shopping points.

In addition to a traditional POS, the Mobile Point of Sale (mPOS) is also a compact device providing convenient card payment services. Currently, you can use your HSBC VISA credit card paid via mPOS to convert any transaction with a minimum value of VND3 million into an instalment plan.

Find out more about instalment program at mPOS at HSBC

You can use VISA cards to make online payments for merchandise both domestically and internationally. Accordingly, you only need to provide your full name, card number, CVV, expiration date and 3D Secure Code to proceed with the payment.

You shouldn't disclose the information to anyone to prevent the fraud.

You can withdraw money using VISA cards (except for VISA Prepaid) at any ATMs with international payment network logos such as VISA / PLUS. However, cash withdrawal fees will be applied as specified in the card issuer's fee schedule.

Find more out: How to save money on your credit card annual fee

Choosing the right VISA card is important. Here are the 3 most important factors to consider when applying for your first VISA card.

Although nearly all banks in Vietnam have issued card lines associated with VISA, card scheme rules may differ from bank to bank. Different schemes will suit you better depending on your lifestyle: some examples include if you want to use your VISA card to pay for tuition, make purchases on instalments or want to travel long-term but are afraid of bringing a lot of cash.

Credit cards from different issuers may also vary in terms of features, limit, charges and fees, conditions for card registration or promotion programs. As each variant has its own advantages, you may want to search the information beforehand to find the right card that best suits your needs.

In case you can't make it to the bank during office hours to apply for a VISA card, there are several banks, including HSBC, that assist users in applying for a VISA card online, instead of only face-to-face applications in a branch.

Specific conditions depend on the bank and type of card you choose but you can refer to the general requirements below:

To apply for an HSBC Visa Debit Card, leave your information at HSBC account opening form. Our staff will contact you to assist in completing the registration application.

And with an HSBC Visa Credit Card, you can apply online in just 6 steps. For more information, refer to How to apply for Visa card online. Apply today and enjoy a first-year annual fee waiver, plus a range of spending benefits designed for you.

Visa card and Mastercard are issued by two different issuing financial institutions: Visa International Service Association and Mastercard Worldwide.

While the two companies don’t extend credit or issue cards, they do partner to offer an array credit and debit card options that will suit your spending and lifestyle habits.

| Visa card type | Primary card | Supplementary card |

|---|---|---|

| HSBC Visa Debit | Free | Free |

| HSBC Visa Livefree | VND350,000 No annual fee upon spending conditions |

VND250,000 |

| HSBC Live+ | VND800,000 | VND400,000 |

| HSBC Visa Platinum Cash Back | VND800,000 | VND400,000 |

| Visa card type | HSBC Visa Debit | HSBC Visa Debit |

|---|---|---|

| Primary card | Free | Free |

| Supplementary card | Free | Free |

| Visa card type | HSBC Visa Livefree | HSBC Visa Livefree |

| Primary card |

VND350,000 No annual fee upon spending conditions |

VND350,000 No annual fee upon spending conditions |

| Supplementary card | VND250,000 | VND250,000 |

| Visa card type | HSBC Live+ | HSBC Live+ |

| Primary card | VND800,000 | VND800,000 |

| Supplementary card | VND400,000 | VND400,000 |

| Visa card type | HSBC Visa Platinum Cash Back | HSBC Visa Platinum Cash Back |

| Primary card | VND800,000 | VND800,000 |

| Supplementary card | VND400,000 | VND400,000 |

The Visa card expiration date is printed on the card in MM/YY format - corresponding to the card's expiration month and year.

For example,10/27 printed on a card means that 31 October 2027 will be the last day your Visa card is valid for payment.