Credit cards normally offer you an interest-free period of up to 45 days before the repayment due date to settle your outstanding balance. All HSBC credit cards do even better than this: you are offered up to a 55-day interest-free period.

The following terms can be useful for you to understand about how an interest-free period works:

Credit card billing date

This date is also called a "statement date". This is the date that marks the beginning of your billing period. Your card issuer records all the transactions you make on your credit card during the period and sends you a billing report.

Your billing date will usually be a fixed date every month. If your statement date falls on a weekend or a holiday, it will usually be generated on the last working day before the holiday.

Payment due date

The date that you are required to pay off your credit card bill to avoid any late fees and finance charges.

Depending on the type of card you're using, the payment due date will be counted from 15-25 days since statement date.

Transaction date

The date you make an authorized transaction with your credit card.

Posting date

The date that your transaction is posted to your card account in the bank system.

Statement balance

This is the total of all your credit card transactions during a billing cycle (plus any outstanding balance from previous statements). It's the full amount you should pay on your payment due date.

Minimum payment due

It's better to pay off your entire statement balance whenever it is due. However, if you are not able to do that, you're still required to make a minimum payment each month. This can range from 1% to 5% of your total balance, depending on your bank.

Grace period

The time between your credit card billing date and your payment due date, in which you have to arrange repayment to the bank. The grace period typically lasts 15 to 25 days, depending on the type of card you’re using.

There are some basic credit cards fees and charges as following:

Interest rate

If you pay off your entire bill by the payment due date, you won't have to pay any interest. If you can't pay the full amount, you will be charged interest on any outstanding balance since the transaction date.

One important thing to note: that interest is retroactive, which means you lose the interest-free period if you don't pay the full amount even you've made the minimum payment.

The interest rate is different for each bank or each card type. It typically falls somewhere between 25% to 40% annually, which is a higher form of interest than you can expect to find with something like a personal loan.

You may refer to our finance charge calculation (PDF) for further details.

Late payment fee

As long as you repay at least the minimum payment required by your payment due date, you won't be charged any late payment fee. If you miss that deadline though, you'll be hit with a late payment fee, which usually ranges from 4% to 6% of the minimum payment due.

Specifically, a 55-day period without interest is the period between your last billing date and your upcoming billing date, plus a 25-day grace period. It works the same for a 45-day 0% interest period, but the grace period you have is up to 25 days instead of 15 days.

55 days interest-free period = A maximum billing cycle 30 days + grace period 25 days

Please note that, this feature is not available for cash advance transactions.

Depending on your purpose when using a credit card, you can choose a card with an appropriate interest-free period and extended grace period.

Depending on the day you make a transaction with your credit card, you could have up to a maximum of 55 days interest-free after using your card. But because of how credit card billing cycles work, you probably won't get the full interest-free period for all of your transactions.

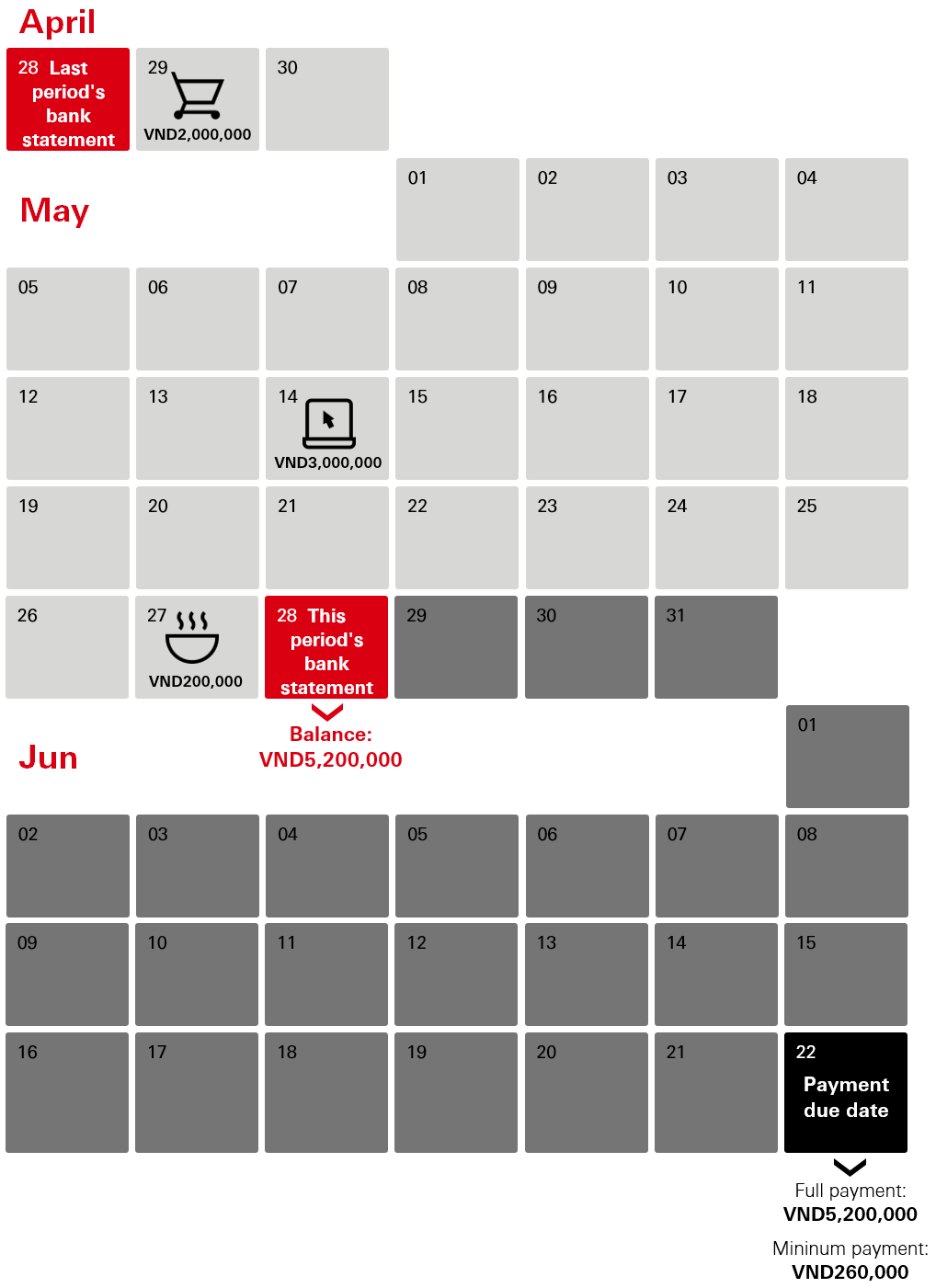

For example, let's say you are using an HSBC Platinum Credit Card with a maximum interest-free period of 55 days.

Today is 28 May. The last month's bank statement date falls on 28 April, this month's statement date is 28 May and the due date is 22 Jun. Now let's look at your purchases from that statement:

These are the interest-free periods for each transaction on your card:

You would take full advantage of the interest-free period if you make your purchases at the beginning of each billing cycle – the first day of the new cycle after receiving your statement of the previous month. That will give you the maximum number of days between your transaction date and your payment due date.

Once you understand the nature of credit card interest-free periods, you will be able to proactively organize your personal purchases to better manage your current financial situation.

Here are a few tips to keep in mind

Only transactions made on the first day in new credit card billing period have an interest-free period 55 days. The number of interest-free days will gradually decrease when the transaction date gets closer to the billing date of each month.

The 55-day interest-free period doesn't apply for cash withdrawals. When you use your credit card for a cash advance the interest rate will start accruing immediately from the moment you withdraw the cash, up until you repay the initial amount, fee and interest charge in full. That's why we recommend that cash withdrawals should only be used in emergencies, and if you decide to do it, try to repay the money as soon as possible.

Credit cards with 45-day interest-free periods are a common with most banks nowadays. At HSBC, we offer interest - free period up to 55 days for all credit cards such as HSBC VISA Cash Back Credit Card, HSBC Live+ Credit Card ,HSBC TravelOne Credit Card and HSBC Premier Mastercard Credit Card to help you better plan out your finances when buying high-value products.

We hope the article has answered your questions about the maximizing your interest-free period when you use a credit card.

Important Information: All fees and interest in this article are for reference only. For the most specific, accurate and up-to-date details on fees, interest and calculation of HSBC credit cards, please refer to the Fee Schedule, Credit Card Agreement and Terms of Use. Other relevant Terms & Conditions are publicly posted and regularly updated on the HSBC website (Vietnam).