General questions about Digital Secure Key

1. Is the Digital Secure Key enough to protect my account?

Yes, you can rest assured that the Digital Secure Key can keep your account secure. It has advanced bank-grade security and protective features.

Once you've activated the Digital Secure Key on your device, it will be linked to your personal Online banking account. No one else will be able to use the Digital Secure Key on their device to log on to your online banking.

Each time you generate a security code, you'll need to verify your identity by entering your 6-digit PIN or using biometric authentication.

2. What will happen to my physical Security Device when I activate my Digital Secure Key?

Once you've successfully activated your Digital Secure Key, your physical Security Device will be deactivated. Only your physical Security Device or your Digital Secure Key can be active at a time, for security reasons. You can use your Digital Secure Key to generate security codes to log on to online banking or verify your transactions without the need to carry an extra device.

3. Can I set up a Digital Secure Key on more than one device?

No, you only can set up a Digital Secure Key on 1 device.

4. I'm a new customer. Can I get a physical Security Device instead of the Digital Secure Key?

We generally encourage all customers to use the Digital Secure Key as it's an easier and safer way to bank online.

From 25 February 2021 onwards, we will no longer issue a physical Security Device to new customers unless you do not have a compatible smartphone. If you're unable to use the Digital Secure Key for any reason, please contact us for further assistance.

5. I want to activate my Digital Secure Key. What should I do?

If you're an existing customer with an active physical Security Device, please update to or download the latest version of the HSBC Vietnam Mobile Banking app. Next, follow the onscreen instructions to activate your Digital Secure Key.

If you're a new customer, simply download the latest version of the HSBC Mobile Banking app. You'll be able to activate and use your Digital Secure Key right away.

6. I'm registered for online banking but I don't have the HSBC Vietnam Mobile Banking app yet. What should I do to activate my Digital Secure Key?

Please note that your physical Security Device will be deactivated once you've successfully activated your Digital Secure Key.

- Download the HSBC Vietnam Mobile Banking app.

- Verify your identity on the app.

- Follow the onscreen instructions to activate your Digital Secure Key.

- Set up a 6-digit PIN. 5.You're all set!

The next time you log on to the HSBC Vietnam Mobile Banking app, you'll see 'Generate a code' at the bottom of the log on screen.

7. I want to continue using my physical Security Device with the HSBC Vietnam app. Can I choose not to activate my Digital Secure Key when prompted?

No, if you select “Decline and log off”, you’ll still continue using physical Security Device and only be able to access your Online Banking (via web browser).

You’ll continue seeing this message in the next time logging on to HSBC Vietnam app until you select “Confirm and continue”.

If you're unable to use the Digital Secure Key for any reason, please contact us for further assistance.

8. I got an error message after entering the security code generated by my HSBC mobile App. Why?

You might have entered an invalid security code (such as an expired code) or used the incorrect 6-digit PIN to generate the security code. Please check and try again.

The security code will expire in 60 seconds.

9. I forgot the 6-digit PIN to access my Digital Secure Key. What should I do?

You can reset your PIN by providing your mobile banking password and the one-time passcode (OTP) that will be sent to you via SMS. Please make sure you have a valid mobile number registered with us so you can receive the OTP to reset your 6-digit PIN.

Simply select 'Forgot your PIN?' on the log on screen, and follow the onscreen instructions.

10. What should I do if I lose my phone?

Please contact us for further assistance.

11. I'm overseas and my phone does not have any internet access. Can I still use my Digital Secure Key to generate security codes?

Yes, you can use your Digital Secure Key to generate security codes even when you're not connected to the internet.

12. Can I switch back to a physical Security Device if I don't like using the Digital Secure Key?

Sorry, you can only apply for a physical Security Device if you're unable to use the Digital Secure Key.

If you're unable to use it for any reason, please contact us for further assistance.

13. I use the HSBC Vietnam Mobile Banking app but I don't want to switch to a Digital Secure Key. Will my access to online banking and other services be affected?

You can continue to use your physical Security Device to access online banking, as long as your device works. However, you won't be able to access mobile banking. You'll only be able to use mobile banking again after you've activated your Digital Secure Key.

When your physical Security Device no longer works (e.g. if it breaks or when the battery dies), you'll need to switch to the Digital Secure Key on the HSBC Vietnam Mobile Banking app.

14. Can other people use my Digital Secure Key to log on to their online banking?

No, other users can't log on to online banking using your Digital Secure Key. Once you've activated your Digital Secure Key, it'll be linked to your personal HSBC bank accounts and can only be used to access your own accounts in online banking.

15. Why does my phone need to be set to automatic Date and Time to use Digital Secure Key?

Digital Secure Key feature generates valid security codes based on the date and time settings of your mobile device, which is automatically updated via your mobile network. To avoid impact on generating valid security codes, please turn on the Automatic settings for Date and Time on your device.

Changes to your HSBC Internet Banking Service

We are continuously evolving and adapting our services to improve your online banking experience. With our enhanced technology as well as simplified design and processes, you can now manage your everyday banking needs easier anytime and anywhere. While we are making an effort to bring you more exciting online banking changes, there are notable changes to the following features starting from 2 December 2019 as below:

General Personal Internet Banking FAQs

1. What's changing?

At HSBC we’re continuously evolving and adapting our services to meet the banking needs of our customers. Over the coming weeks, we’ll be making some exciting changes to our online banking services and public web-site.

We’re introducing a fresh look, creating a better customer experience and making it even easier for our customers to manage your accounts online.

2. Which features are receiving the enhancement?

The following features will be improved with the New Internet Banking:

- Log On Process

- Accounts View

- Payments and Transfers

3. What's changing for payments or transfers?

Our enhanced move money feature will replace the traditional transfer options, making it simpler for you to move money between accounts.

4. When will I get to experience the new Personal Internet Banking?

To ensure everyone experiences a smooth transition, we will be upgrading customers over a period of time. Stay tuned for an announcement from us! We will notify you when it’s your turn to receive the upgrades.

5. How will customers be notified of the enhanced online banking service?

You will be contacted by e-mail or post, depending on your contact preference, to notify that the enhanced online banking service is available for you to use. Once you’ve received confirmation that the changes are available to you, you can log on as normal from www.hsbc.com.vn and follow the on screen instructions. Your logon details will remain the same.

6. Why I am redirected to the old platform for some features?

We are gradually bringing the existing features to the new platform in our future upgrades. Please stay tuned

7. Why did I not receive the SMS OTP to activate my Security Device? What should I do?

The activation code message will be sent to your registered mobile phone number within 01 to 03 minutes after generating the activation code. In some unexpected case beyond the control of the Bank, the activation code sending will be delayed or unsuccessful as it depends on your current network service provider.

After 03 minutes, if the SMS still have not been sent to your registered mobile phone number, please check whether your mobile phone number had been changed recently. If yes, please ensure that your new mobile phone was updated with us. In case you want to update your new mobile phone number, please directly visit our Branch/Transaction Offices on working hours (Monday to Friday) or contact our Customer Service Centre on (84 28) 37 247 247 (the South) or (84 24) 62 707 707 (the North), which operates from 8:00am until 10:00pm daily for further assistance.

8. Can I receive the activation message if I am abroad?

Activation code notification message can be sent to Vietnam mobile phone or international mobile number as long as this number is registered with us. If you are using a Vietnam phone number, please ensure international data roaming is activated while you are abroad. Service charges may apply and will be charged by the mobile network service provider you are using. Depending on the country/ territory, the sender name may be shown as "HSBC" or the switchboard number.

9. What should I do if I receive notification that: "You have requested the activation code many times, please contact us for assistance"?

You can only press to request the activation code up to 5 times. After 5 attempts, a message will be displayed asking you to Customer Service Center on (84 28) 37 247 247 (the South) or (84 24) 62 707 707 (the North), which operates from 8:00am until 10:00pm daily for assistance.

10. I was using Online Banking normally, but when I log on, there was a message asking me to create a new password. What does this mean?

HSBC bank strive to bring you new features for more secure banking services. Therefore, from July 14, 2020, when you log on your Online Banking, you will be asked to create a new login password.

11. What is the inconvenience I might face if you don't create a new password?

- If you used to use the HSBC Vietnam app, you will not be able to re-install HSBC Vietnam app if you remove the app from your current device or change your device and want to install HSBC Vietnam app.

- If you haven’t used the HSBC Vietnam app before, you will not be able to install the app at the identification verification step.

12. How to set up my password?

Upon logging on to your Online Banking with your username, you will be prompted to create a password. You will be advised to follow the instructions on screen in order to complete the new password creation, please refer here for more details.

13. After being asked to change my Online Banking security password, can I still log on with my username and security code in the same way as before?

Yes, for customer confidentiality reasons, the Bank requests you to change your password. After the security password has been set, in the next times, you can log on your Online Banking in the same way as before.

14. How many times do I have to request for my password resetting?

You can send up to 5 online requests within 24 hours. On the 6th request, an error message will be displayed and you will be asked to contact Customer Service Center on (84 28) 37 247 247 (the South) or (84 24) 62 707 707 (the North), which operates from 8:00am until 10:00pm daily to complete the password setup.

Account and Log on

1. What are the changes to the logon process?

You will no longer require touse your primary password to log on to HSBC online banking.

Old way to log on: To log on to HSBC Online Banking, you need to enter your username and your security code generated by your security device.

New way to log on: You will only need to enter your username and then your security code generated by your HSBC Vietnam App.

2. Why am I no longer required to log on with my primary password?

The primary password has been removed to provide you a simpler, faster, yet just as secure online banking experience with your Security Device. Rest assured, your security and the online banking functionality will not be compromised at any time.

However, as we are continuously upgrading online banking features, you will still need to set up a primary password while registering for HSBC online banking.

3. How can I open a new account or a time deposit account with the new Accounts Page?

All other features of the old Internet Banking has been moved to the top of the page under four categories: Move Money, Services, Our Products and Help & Support. For opening a new account or a time deposit account, please click on Services at the top of your Accounts page and follow through the on-screen instructions as per normal process.

4. I'm having trouble logging on to Personal Online Banking. What should I do?

If you have registered with Personal Internet Banking and you can't log in, first double-check you entered your details correctly. If you still can't log on, write down the error message and call Customer Services:

- Personal Banking customers (8am to10pm daily): (84 24) 62 707 707 (the North)

- Personal Banking customers: (8am to10pm daily) (84 28) 37 247 247 (the South)

- Platinum Credit Card holder (24/7): (84 28) 37 247 248

- Premier customers (24/7): (84 28) 37 247 666

5. Where can the customer find the full transaction details on the new version?

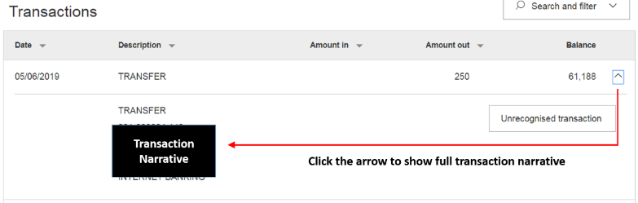

The full transaction narrative is collapsed by default on the new platform. On the Account History page, please click the arrow on the right of Balance to expand the transaction narrative.

6. What is Quick Links and can I customize which ones to be on the menu?

You can locate Quick Links on the top of the Account Summary page, click on the arrow and expand or hide the menu of Quick Links on the Online Banking homepage. Quick Links menu is provided for easier access to the most commonly used banking services.

For now, the icons of the Quick Links are fixed. There will be continuous enhancements made to advance your experience of banking with us.

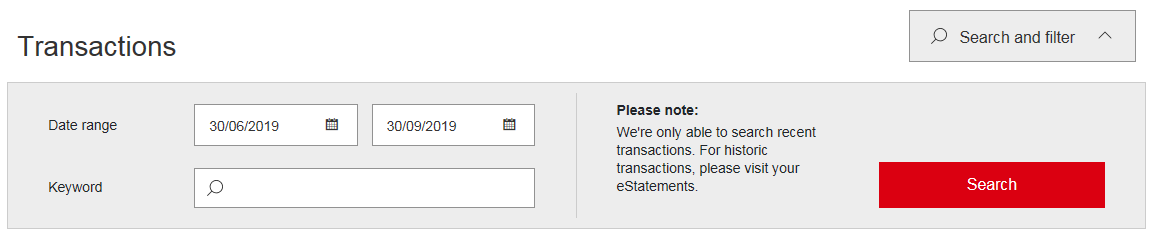

7. Can I search a transaction in my Accounts?

To search for a specific transaction, select the magnifying glass icon Search and filter function above your account transaction list. Search can find banking and credit card transactions made in the last 90 days.

Note: Loans, Term Deposit Accounts and Mortgages are not supported for Search and filter.

8. I find a print button on the page, what is its function?

Some pages provide a “Print” button to create an easy-to-read, print-friendly version of the page that you are viewing. This can then be printed.

Payments and Transfers

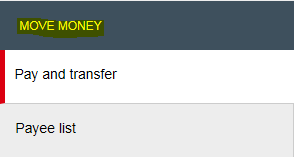

1. What does Move Money mean?

Move Money is a single place for managing all your transfers from your HSBC accounts worldwide. With Move Money you can:

- Transfer money between your own accounts, other HSBC accounts and third-party accounts, domestically and internationally in VND and other supported foreign currencies.

- Save a payee easily for future transfers.

- Send money to an existing payee or add a new payee.

- Set up an immediate transfer, dated or recurring transfer

2. What is “Add to your payees”?

Simply click “Add to your payees” if you would like to save beneficiary’s detail into your Internet Banking for simpler regular transfers. This is a useful feature if you transfer regularly (for example, pay school fees) to the third-party account without entering again details of beneficiary.

Furthermore, The maximum daily limit for transfers to “My Payee” is higher than Non-registered payee which is maximum of 2 billion VND.

3. How can I make a transfer to my saved payees?

We have simplified the transfers for your saved payees. Right after selecting the source account for the transfer, just select "Your accounts or someone you've paid before" option so you can have a full list of the saved payees.

4. Can I still make transfers to and from any of my accounts?

You can still make transfers to most of your Internet Banking accounts. It has now been simplifie d with which transferring through your own accounts (both domestic and international) would have the same experience as transferring to your saved payees or beneficiaries.

5. I could no longer see Global View in the Accounts page. How can I make transfers to my own international accounts this time?

We have made the transfer of money experience more simplified by incorporating the transfer to you own international accounts through the same way as transferring with your domestic accounts and saved payees.

Just click on "Pay and Transfer" in the Quick Links portion of your Accounts page and after you have selected your source account, select "Your accounts or someone you've paid before" then you will be able to see your own international account as one of the beneficiary accounts to select from.

6. How can I make a transfer with a new account?

You can still make a transfer to a new bank account via the new payment transfer selection feature. After selecting the source account for the transfer, just select the option "New payment to a person" and you'll be directed to the next screen asking for the relevant information for your new payee account. Just remember to add this account to your payees so you won't have to do the whole process of entering its details all over again.

7. How do I know what beneficiary-specific information I need to input into my security device?

Please follow the on-screen instructions on the security code input page on HSBC online banking to input the correct information into your security device and generate the required security code.

More examples on inputting beneficiary’s account number

Scenario 1: Beneficiary account number / bill reference number with 8 or more digits

| Example |

Original number |

Input |

|---|---|---|

| Example 1 |

123-456-789 |

23456789 |

| Example 2 |

55500066777 |

00066777 |

| Example |

Example 1 |

|---|---|

| Original number |

123-456-789 |

| Input |

23456789 |

| Example |

Example 2 |

| Original number |

55500066777 |

| Input |

00066777 |

Scenario 2: Beneficiary account number / bill reference number less than 8 digits

| Example |

Original number |

Input |

|---|---|---|

| Example 1 |

123456 |

00123456 |

| Example 2 |

0708 |

00000708 |

| Example |

Example 1 |

|---|---|

| Original number |

123456 |

| Input |

00123456 |

| Example |

Example 2 |

| Original number |

0708 |

| Input |

00000708 |

Scenario 3: Beneficiary account number / bill reference number comprising letters and 8 or more digits

| Example |

Original number |

Input |

|---|---|---|

| Example 1 |

123A4567BC89D |

23456789 |

| Example 2 |

AB11-200CD777 |

11200777 |

| Example 3 |

333Y 44W 5555 |

33445555 |

| Example |

Example 1 |

|---|---|

| Original number |

123A4567BC89D |

| Input |

23456789 |

| Example |

Example 2 |

| Original number |

AB11-200CD777 |

| Input |

11200777 |

| Example |

Example 3 |

| Original number |

333Y 44W 5555 |

| Input |

33445555 |

Scenario 4: Beneficiary account number/bill reference number comprising letters and less than 8 digits

| Example |

Original number |

Input |

|---|---|---|

| Example 1 |

123A |

00000123 |

| Example 2 |

AB11-2 |

00000112 |

| Example 3 |

3Y 4W |

00000034 |

| Example |

Example 1 |

|---|---|

| Original number |

123A |

| Input |

00000123 |

| Example |

Example 2 |

| Original number |

AB11-2 |

| Input |

00000112 |

| Example |

Example 3 |

| Original number |

3Y 4W |

| Input |

00000034 |

8. What should I do if I have entered a wrong number into my security device during the authorization process?

If you have entered a wrong number into your security device, press the green button to backspace and delete your last entry. To clear your entire entry, press and hold the same green button.

9. What should I do if the security code I have input on HSBC online banking is not accepted?

- Please ensure the security code you have input matches the security code displayed on your security device.

- If the security code matches the security code on your device, the beneficiary-specific information entered previously may be incorrect.

- Please follow the on-screen instructions and repeat the process to generate a security code.

If the security code is still not accepted you may call our Contact Center (84 28) 37 247 247 for assistance.

10. What if my computer crashes or I'm disconnected from the internet in mid-transaction during Personal Internet Banking?

Once you are back online check your account balances and transaction history. If you think there's a problem, call our Contact Center (84 28) 37 247 247 for assistance.

- Personal Banking customers (8am-10pm daily): (84 24) 62 707 707 (the North)

- Personal Banking customers: (8am-10pm daily) (84 28) 37 247 247 (the South)

- Platinum Credit Card holder (24/7): (84 28) 37 247 248

- Premier customers (24/7): (84 28) 37 247 666

11. I can't find the bank I would want to transfer money to from the bank list. What should I do?

When searching for a bank in the Bank Search feature upon doing a money transfer, you should search the complete name of the bank or the bank's SWIFT code.

If in case you're still not able to, you may call our Contact Center hotlines for further assistance.

- Personal Banking customers (8am-10pm daily): (84 24) 62 707 707 (the North)

- Personal Banking customers: (8am-10pm daily) (84 28) 37 247 247 (the South)

- Platinum Credit Card holder (24/7): (84 28) 37 247 248

- Premier customers (24/7): (84 28) 37 247 666